THREE POINT ZERO

Helping you invest in the Australian property market the ‘Zero’ Way

Investing In Property Made Easy

Our tried and tested Three Point Process has been refined over hundreds of clients. You’ll be guided through the process from day one.

That’s a Zero risk* process, for your piece of mind.

Educate

Zero Obligation Discovery Call

Invest

Asset Type Assessment

Develop

Meet Your Financial Goals

Your Property Investment Hub

We’re on a mission to redefine the future of property investment. Our Three Point Process integrates third-party validation to ensure our practices are transparent and tailored to support your individual investment goals and objectives.

Finance & Mortgage Brokers

Our independant finance specialists will help you get the right loans in place.

Conveyancers & Settlement Agents

Our experts ensure the “legal stuff” is taken care of. Every. Single. Time.

Tax Accountants & Financial Planners

Tax and financial planning is essential. Our partners can provide support when you need it.

Building Inspections

Independent building inspections ensuring your asset is built to the highest standard.

Property Management

Effective property management optimizes rental income and preserves the value of your asset through meticulous oversight.

Complete Back-End Support

From your initial enquiry to handover and beyond, we’re with you every step of the way.

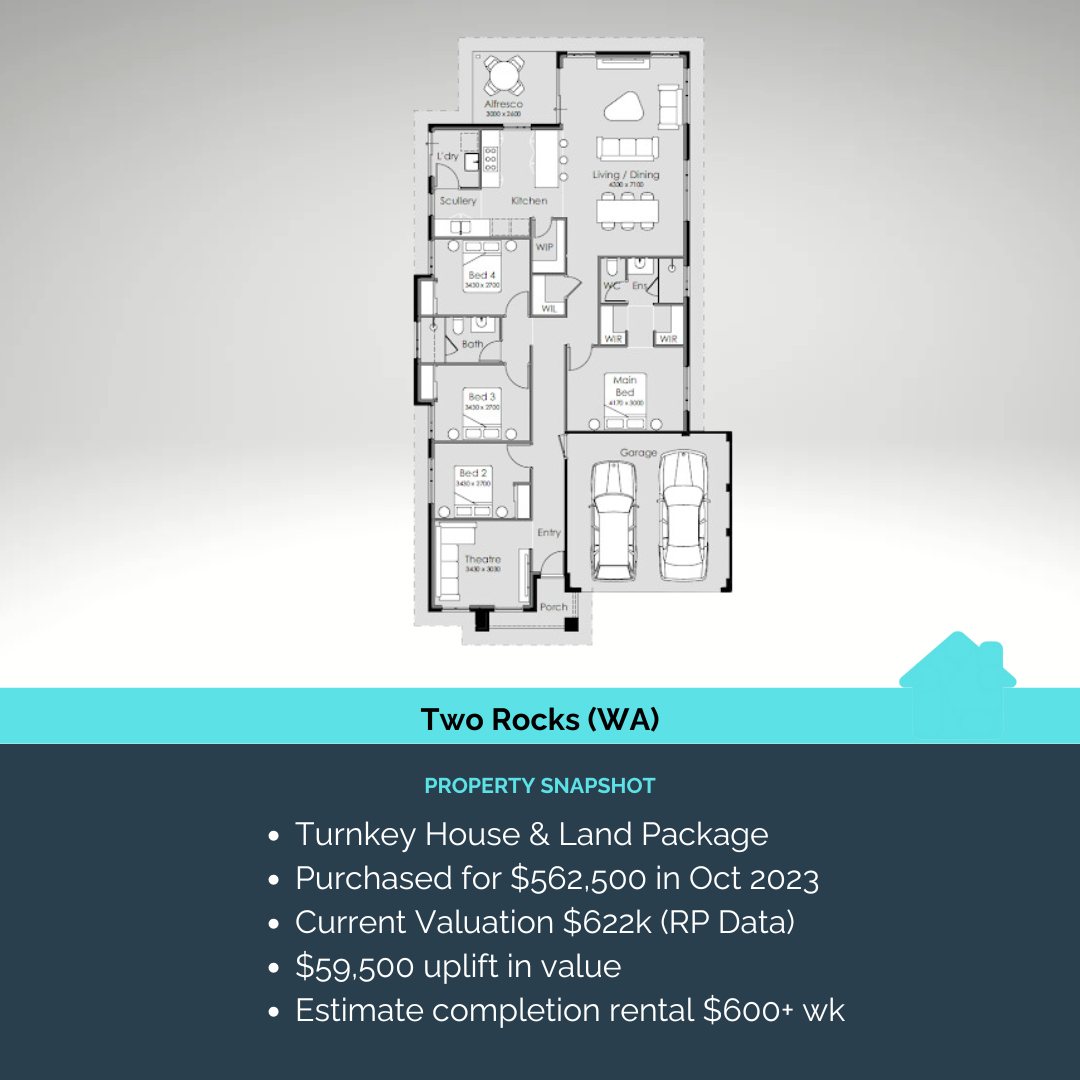

Property Snapshots

Recent property success examples of our clients on their journey towards financial independence.

At Three Point Zero, we provide independent services and advice based upon data driven research and industry experience. We’re free from conflicts of interest such as in-house teams of finance brokers, property solicitors/lawyers and tax accountants to name a few.

With over 25 years of combined expertise, our experienced leadership team has overseen more than 800 property transactions on behalf of our clients.

You can count on us to be there every step of the way, providing you with the guidance and support you need to navigate through your journey.

Education Centre

Everything you need to know about Property investing.

The discovery session marks the beginning of our journey together, providing an opportunity for us to meet and discuss your goals, assess your current financial status, and introduce you to the ins and outs of property investment, supported by relevant data. We also explain our business approach during this meeting. You are encouraged to come prepared with any questions you might have!

The effectiveness of each investment strategy varies based on your individual circumstances, as all strategies have their merits but may yield better results for certain investor profiles. We can provide a detailed breakdown of how each strategy aligns with your situation in a strategy session.

Rentvesting is an approach to homeownership where you live in a rented property that suits your lifestyle needs, and simultaneously own a separate investment property that fits within your budget. With the rise in home prices in urban centres, this strategy has become more appealing, particularly to the younger demographic.

Typically, investors would be expected to provide a minimum deposit of approximately 10% of the purchase price (this can also come in the form of equity – see below).

Equity is the difference between the property’s current market value and the outstanding loan amounts. It represents the part of the property’s value that you own outright. As you pay off your mortgage and/or the property’s value increases, your equity grows.

We hold the view that it’s always a suitable time to invest in property, as every phase of the property market presents various opportunities tailored to the unique objectives of investors. The focus should be on long-term participation in the market rather than attempting to predict its fluctuations.

We can assist you in finding investment properties across Australia, an approach we refer to as borderless investing.

Capital Gains Tax (CGT) applies to the profit earned from selling assets like real estate. You must declare any capital gains or losses on your annual income tax return, with taxes due on your gains. Despite being called capital gains tax, it integrates into your broader income tax obligations, rather than constituting a distinct tax.

Lenders Mortgage Insurance (LMI) is a policy lenders acquire to protect themselves from potential loss if the borrower fails to repay the loan and the subsequent sale of the property doesn’t cover the remaining loan amount.

Stamp Duty represents a tax levied by state and territory governments across Australia, extending beyond merely the acquisition of residential properties. It is applicable to a diverse array of transactions involving the sale or transfer of various personal and commercial assets.

Negative gearing occurs when you take out a loan to invest in property, making your investment geared. It refers to a situation where the expenses of maintaining a rental property surpass the income it generates. The main advantage of negative gearing is the ability to deduct any net loss from the property from other sources of income, like your salary, during the financial year. This can lead to a reduction in your overall taxable income and consequently, the amount of tax you owe.

Rental yield is the profit you earn from an investment property, calculated by comparing the total expenses against the income generated from renting it out. Knowing your rental yield helps you assess whether the financial performance of the property is sustainable.

Property depreciation in Australia refers to the tax deductions investors can claim for the decrease in value of the property’s physical structure and items attached to it, as well as for the depreciation of plant and equipment assets contained within the property, such as ovens, dishwashers, carpets, and blinds. This acknowledges the wear and tear on the property and its contents over time.

Contact Us

Drop us a quick message and we’ll get back to you soon.